· I'mBoard Team · general · 3 min read

6. 😮 The Art of the Surprise: How Not to Sync Board Members Before Meetings

Learn how to master boardroom chaos (or avoid it) with this satirical guide for startup CEOs. Explore why poor stakeholder communication tools, missed board updates, and last-minute surprises can damage trust—and even impact D&O insurance for startups.

🚨 Disclaimer: This guide is purely satirical and intended for entertainment purposes only. Any actual attempts to follow this advice could significantly increase friction with your board, complicate your startup governance, or void your D&O insurance. Proceed responsibly—or better yet, don’t. Especially if you enjoy affordable D&O insurance for startups.

Welcome back to The Startup CEO’s Guide to Mastering Boardroom Chaos, your definitive handbook for subtly—or not so subtly—ensuring every board meeting remains unforgettable.

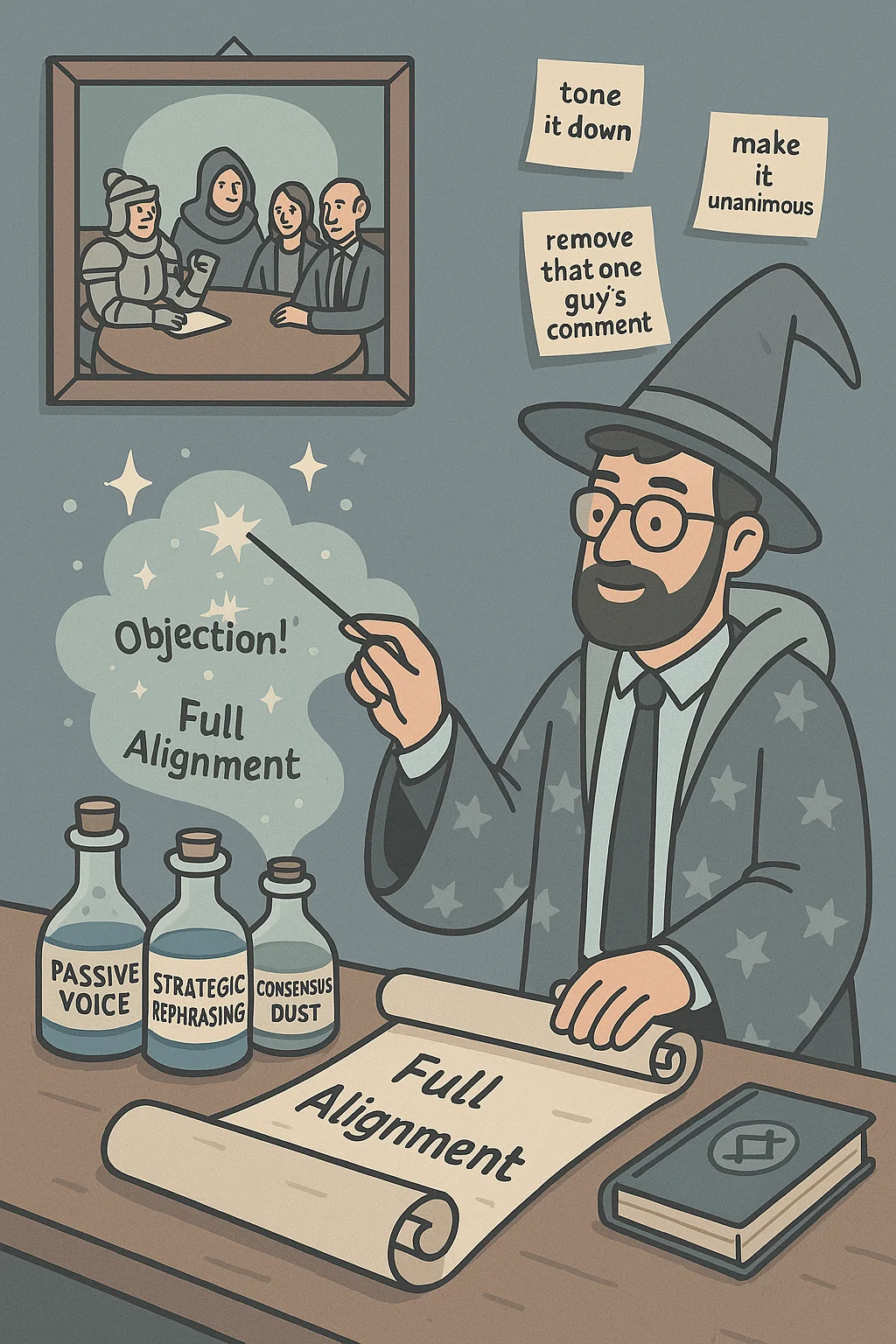

Today’s lesson: The Art of the Surprise. Forget tedious concepts like “alignment” and “preparation.” True boardroom legends thrive on the gasps, frantic Slack messages, and stunned silences.

Pro tip: This approach pairs wonderfully with the higher premiums D&O insurance startups adore.

Missed earlier episodes of chaos? Check the series navigation at the end.

🎭 Real Leaders Chase Genuine Reactions – Preparation Is for Cowards

Why deny yourself life’s purest thrills? Real CEOs understand briefing board members ahead of meetings only dilutes their genuine reactions.

Instead, stride confidently into the room armed with shocking news, bold pivots, and perhaps an unexpected acquisition nobody saw coming. Shock is the ultimate influencer.

CEO: “We decided yesterday to sunset our core product. Exciting, right?”

Lead Investor (visibly pale): “Wait… core product?”

Of course, some less adventurous types still cling desperately to pre-reads and stakeholder communication tools like “briefings.” Bless their cautious hearts.

🫱🫲 Selective Syncing - Divide Conquer and Feign Surprise

If syncing with board members feels unavoidable, at least keep it inconsistent.

Brief just two—preferably the least relevant—and leave the rest blissfully unaware.

This strategy ensures plausible deniability. When the meeting devolves into open civil war, you can genuinely exclaim, “But I thought everyone knew!”

CEO: “I ran it by Bob, and he agreed.”

Board Member: “Bob manages a dog-food fund. This is a B2B AI decision.”

Traditionalists might still argue that briefing relevant expertise yields “better outcomes,” even daring to reference archaic concepts like startup board of directors responsibilities. As if those still matter.

📞 Trust Board Members Never Talk to Each Other

Imagine each board member confined to a tidy little silo, blissfully ignorant of their peers’ conversations.

Now, actively build your update strategy around that delightful fiction.

Deliver slightly varying narratives to different directors, then enjoy the ensuing spectacle.

Board Member A: “You said the burn rate is $300K.”

Board Member B: “You told me $450K.”

CEO (weak smile): “Numbers evolve. It’s a startup.”

Some say certain CEOs actually attempt “consistent messaging” to avoid such drama, leveraging stakeholder communication tools like status updates, pre-reads, and phone calls. Brave souls, indeed.

🎬 Deliver Critical News Live and Pretend the 2AM Pre-Read Counts

The optimal time to disclose layoffs, SEC inquiries, or mass customer exodus is undoubtedly mid-meeting.

If anyone dares object, calmly remind them you did send an update—a 112-slide deck emailed at 2:04 AM, hidden between the updated mission statement and an appendix labeled “optional marketing experiments.”

CEO: “It was all in the pre-read I sent last night.”

Board Member: “The one timestamped 2:17 AM?”

Other Board Member: “I fell asleep by slide seven.”

Some old-fashioned directors maintain that major updates deserve daylight, preparation, and thoughtful handling—aligned with those dusty documents on startup board of directors responsibilities nobody reads anymore.

🎁 Congratulations You Have Mastered Boardroom Mayhem

Bravo. You’ve fully embraced your inner chaos artisan:

- No prep? Check.

- Selective misinformation? Check.

- Real-time meltdowns? Expertly delivered.

Next time someone brings up “alignment,” just smile enigmatically and schedule another 9 AM surprise.

And if asked why your D&O insurance for startups suddenly tripled, confidently reply it’s the cost of “leading boldly.”

Stay tuned for the next guide: Confusing Your Board with Jargon.